A spousal RRSP is a plan that is opened in your spouse’s name to which you make contributions. With a spousal RRSP, the contributor claims the tax deduction, but the contributor’s immediate benefit stops there. Your spouse will be the legal owner of the plan and, as such, will make all the investment decisions and withdrawals. The total contributions you make to both your plan

and a spousal RRSP may not exceed your contribution limit. In addition, any contribution you make to a spousal RRSP does not affect your spouse’s deduction limit for the year.

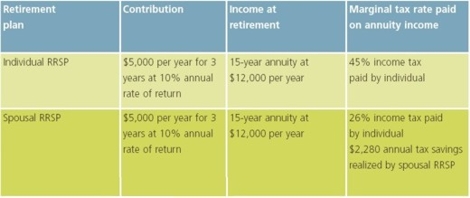

The advantage of a spousal RRSP is that it can provide you with opportunities to split income before and after retirement. Tax savings are realized when the spouse residing in the lower tax bracket down income from the plan. The net effect is that the couple will pay less tax overall.

Withdrawals from a spousal RRSP will be taxed in your spouse’s hands provided that the contributor has not invested any amount in any spousal plan in the current or preceding two calendar years. If the spouse makes a withdrawal before maturity and the contributor has deposited cash or other assets to the spousal RRSP in the current or preceding two calendar years, the amount withdrawn (up to the amount of the contributor’s deposit) will be included in the

contributor’s income for that year. Provided you have sufficient earned income, contributions can be made to a spousal RRSP until the end of the year in which your spouse turns 69.

INCOME SPLITTING CAN SAVE YOU TAX

The following table helps illustrate how income splitting can work. In this example, a couple withdrawing the same amount of income are able to save $2,280 annually by using this strategy.