Mortgage Insurance

When you arrange a mortgage with your financial institution, the law requires them to ask you if you want to insure your mortgage. This will guarantee that your mortgage will be paid off should you die.

When you arrange a mortgage with your financial institution, the law requires them to ask you if you want to insure your mortgage. This will guarantee that your mortgage will be paid off should you die.

There are 2 ways to insure your mortgage:

- with either individual or group mortgage insurance through your mortgage lender

- with your own individual life insurance

What’s the difference?

Isn’t one kind of insurance as good as the other?

Why shouldn’t you sign up for mortgage insurance with your financial institution at the same time that your signing the mortgage documents?

See for yourself.

Protect more than just your mortgage / Mortgage insurance vs. term insurance

When David bought his first house, he was 32, single, and with no dependents. When he got the mortgage from his bank, they offered him mortgage insurance to cover his mortgage balance in the event of his death.

When David bought his first house, he was 32, single, and with no dependents. When he got the mortgage from his bank, they offered him mortgage insurance to cover his mortgage balance in the event of his death.

At first, David declined. After all, he didn’t have any dependents that would still be living in the house if anything happened to him.

But neither did he want to burden his family with having to sell the house to pay off the mortgage. So, David purchased the mortgage insurance.

Then, as happens to all of us, life happened to David. Over the next few years, David got married, financed a new car, and started contributing more to his RRSP’s.

When their first child arrived, David and Linda started putting money away to save for their education. As they grew, David needed to move their family into a bigger house.

Falling in love with a home in a neighborhood perfect for raising kids, David and Linda had to refinance the original mortgage. Once again, the bank offered them mortgage insurance to cover the new mortgage.

But this time, with David’s additional debt and dependents they wondered if mortgage insurance was really the right choice.

As part of their research, David and Linda consulted their financial advisor. They were a little confused when she suggested a personally owned term insurance policy as the better solution. After all, David already had adequate life insurance, or so he thought.

Their advisor explained that even though David already had insurance coverage, they needed to protect their family from the additional debt load they were assuming. And personally owned term insurance would not only protect their family, but also offer some additional benefits.

Let’s examine the differences between mortgage and term insurance.

What is mortgage insurance?

Mortgage insurance is offered by most banks and lending institutions. They’ll offer it to you when you get a mortgage or refinance your existing one.

It’s an insurance policy that pays the balance of your mortgage to the lending institution if you, the person listed on the mortgage, passes away.

Mortgage insurance provides a life insurance amount equal to your remaining debt. As your mortgage decreases, so does the payout you receive.

The cost of the insurance is based on the mortgage amount and your age at the onset of the mortgage, and the payments remain constant through the life of the policy. Essentially, you’re paying the same monthly premiums for a reducing amount of coverage as you pay down your mortgage.

And mortgage insurance (group insurance) is great for the lender because they are listed as the beneficiary of your policy.

How does Personal Individual Term Insurance cover my mortgage?

Term life insurance provides protection for a specified period of time. A death benefit is paid to your beneficiary if you die while the policy is still in force.

When you purchase a term life policy, you are covered for the full amount of your mortgage, not just the outstanding balance, for the life of the policy. That means you have a constant level of coverage for the whole term.

It’s usually cheaper and you choose your beneficiaries. And the proceeds from your term insurance can be used in any way your beneficiary deems necessary – not just to repay the mortgage.

Your best option

Buying a new home is the perfect time to purchase term insurance to protect your mortgage and your family.

Based on its flexibility, coverage, and price, term insurance is a superior option to mortgage insurance.

Talk to me about the benefits of term insurance, and how it can help you keep the house you worked so hard for.

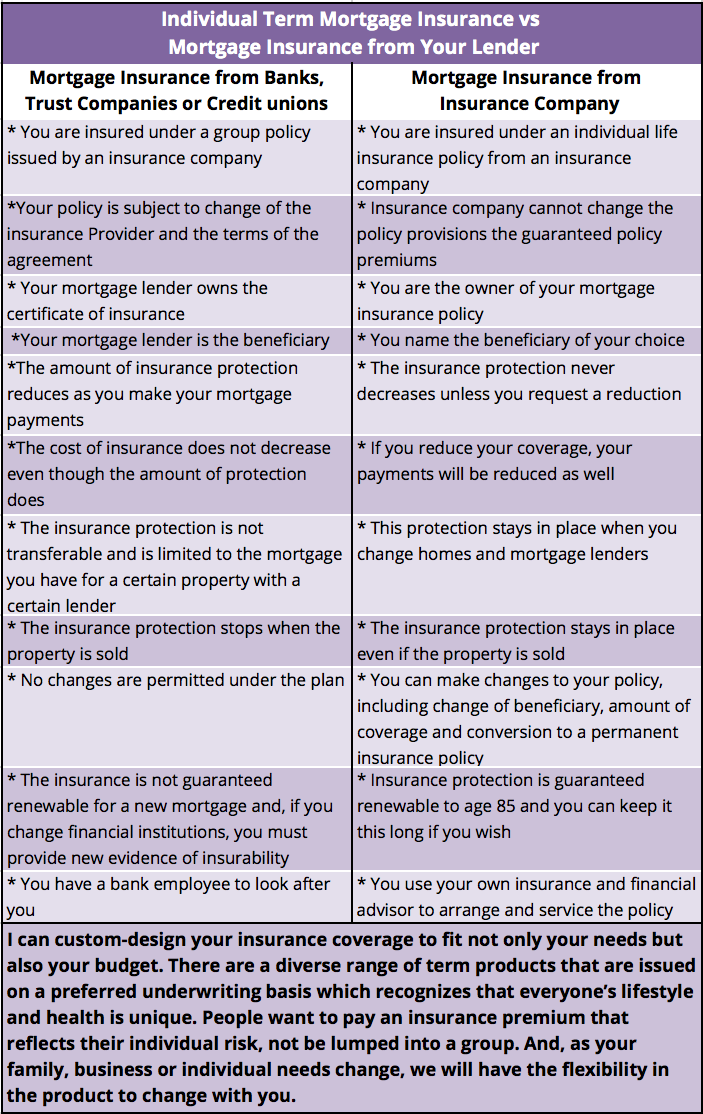

Comparing mortgage and term insurance

Take a look at the differences between protecting your mortgage with personally owned term insurance versus most lenders’ mortgage insurance.