Critical Illness Insurance

The New Risk of the 21st Century

“The Protection You Need – When You Need it Most”

“People need insurance not only because they are going to die, but because they are going to live.”

“People need insurance not only because they are going to die, but because they are going to live.”

This is a quote from world renowned heart surgeon Dr. Marius Barnard who helped develop critical illness insurance. Dr. Barnard witnessed the emotional strains that many of his patients faced after surviving serious illnesses. Financial stress often worked against recovery or, in many cases, left patients struggling to pay bills as they resumed their lives.

Critical Illness Insurance creates a personal financial health line of credit which entitles you to a lump sum tax-free cash payment – upon diagnosis and survival of a critical illness. The beauty of this line of credit is that you never have to pay it back.

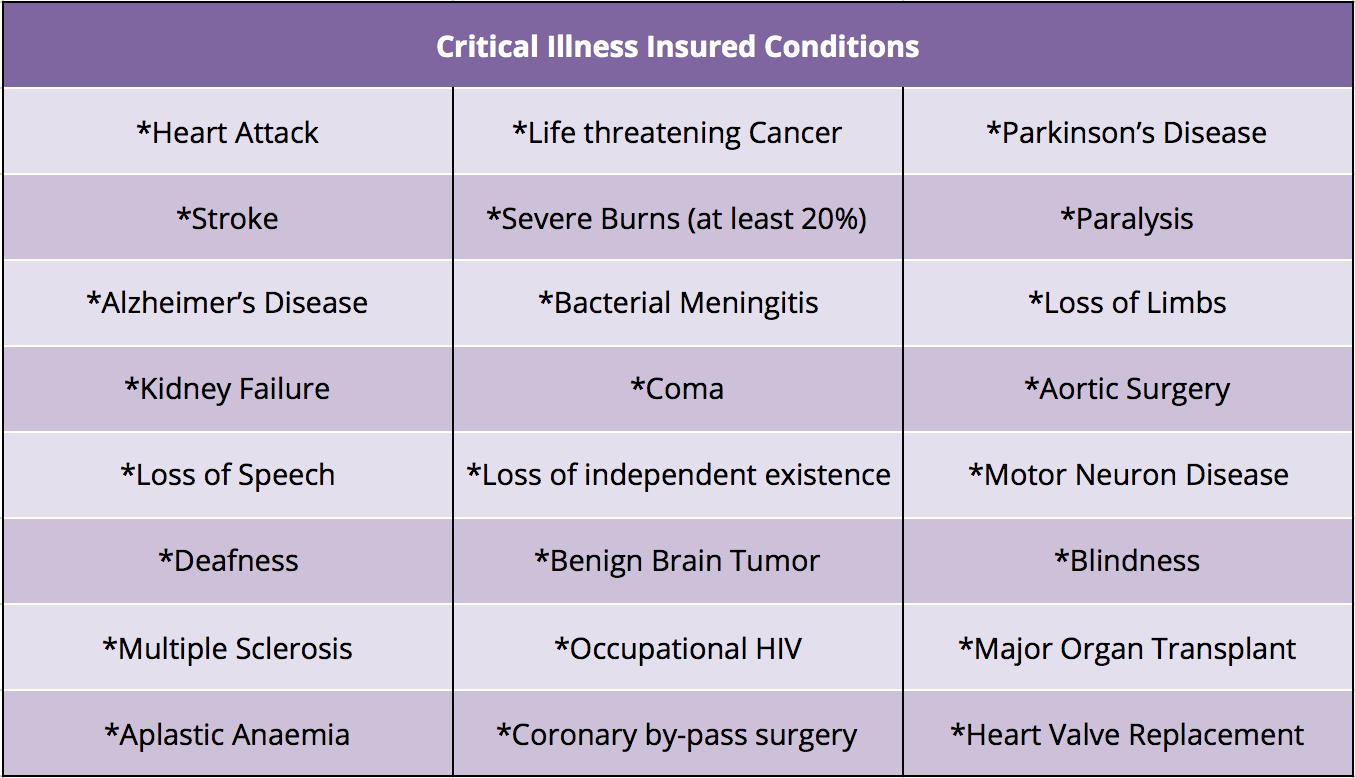

Most companies have 20-24 covered conditions, and is usually payable 30 days following the diagnosis of a covered condition and most connect you with the services provided by ‘Best Doctors’. Best Doctors is one of the world’s pre-eminent independent authorities of healthcare, who can put you in touch with physicians, hospitals and provides treatment assistance services, when you need it most.

Canadians need critical illness insurance. It’s a fact. A serious, life altering illness strikes one in three Canadians in their lifetime. Consider these statistics:

Heart Disease:

- 1 in 2 men and 1 in 3 women are predicted to develop heart disease in their lifetime.

- It is estimated there are over 70,000 heart attacks each year.

- Over 80% of heart attack patients admitted to hospital survive. In recent years the rate of death among patients has dropped from 16% to 8%.

Cancer:

- 1 in 2.3 men and 1 in 2.6 women living in Canada will develop cancer during their lifetime.

- An estimated 149,000 new cases of cancer and 69,500 deaths will occur in Canada in 2017.

- On average 2,865 Canadians will be diagnosed every week – 1,337 will die every week

- 1 in 8.8 women will develop breast cancer in their lifetime

- 1 in 8.3 men will develop prostate cancer in their lifetime

- 38% of women and 44% of men will develop cancer during their lifetime

Stroke:

- Each year about 16,000 Canadians die from stroke

- Each year, more women than men die from stoke (In fact more women die of heart disease than all the cancers combined)

- For every 10,000 Canadian children under the age of 19, there are 6.7 strokes.

- After age 55, the risk of stroke doubles every 10 years

- A stroke survivor has a 20% chance of having another stroke within 2 years

- Effects; of every 100 people – 15 die – 10 recover completely – 25 recover with a minor impairment or disability – 40 are left with a moderate or severe impairment – 10 are so severely disabled they require long term care.

So the scary part is that out of the 85 that live – 75 need some form of care – which has a direct ripple effect on loved ones who have to take care of them.

Multiple Sclerosis:

- Every day 3 people in Canada are diagnosed with MS

- MS is the most common neurological disease among young Canadians

Alzheimer’s:

- 238,000 Canadians over 65 have Alzheimer’s – 750,000 by 2031

Source: National Cancer Institute of Canada, Canadian Cancer statistics 2002, Statistics Canada, 1999, Heart and Stroke Foundation, 2001, Alzheimer’s society 2002

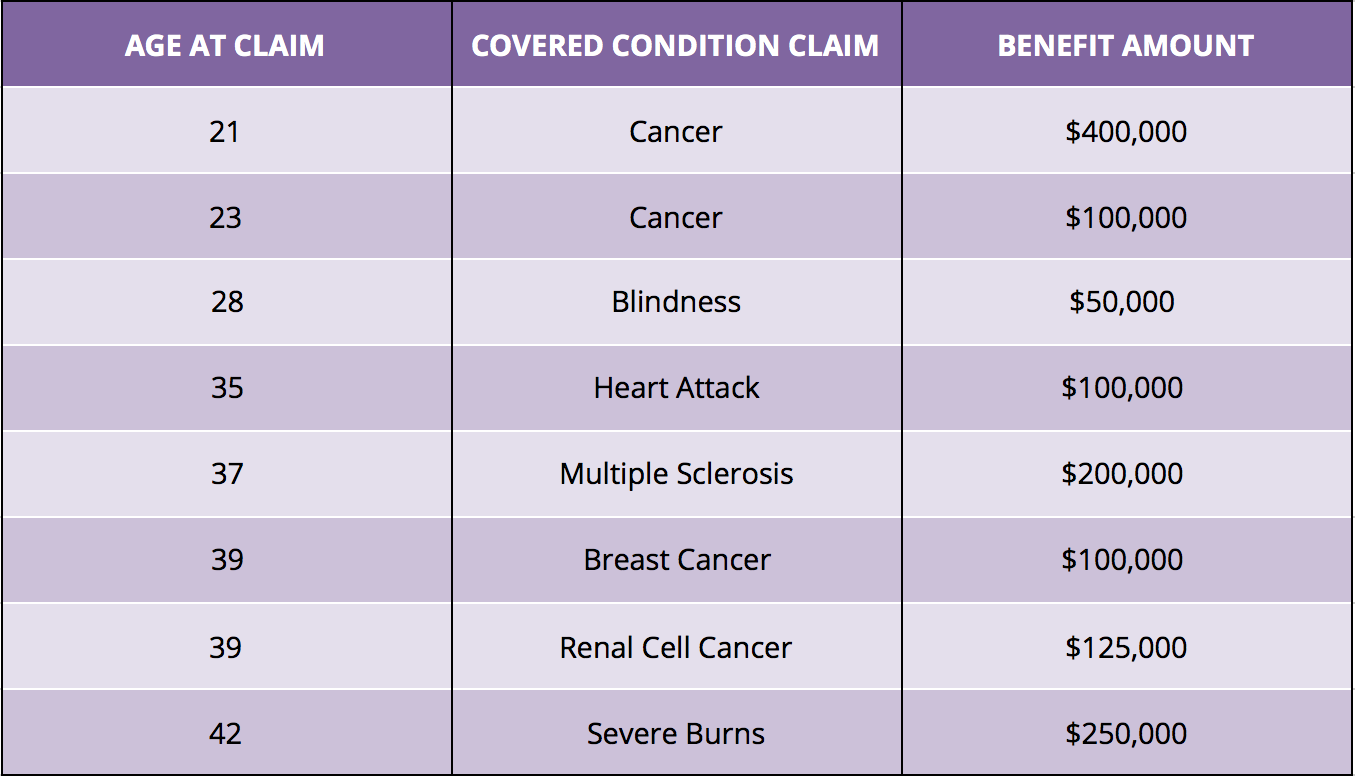

The risks are very real and so is the probability of survival. For most insurance companies, 80-85% of the claims that they pay out are for the top 3 critical illnesses; cancer 62-64%, heart attack; 17 -20%, and strokes; 6-10%. Did you know that, on average, people are in their 40’s when they receive the critical illness benefit? But it can happen even younger…see below (real claims)

Do you know any relatives, friends, or business associates who suffer or have suffered a critical illness?

If so, ask yourself the following questions:

- Could they cover all their medical expenses?

- Would they have benefited from a lump sum tax-free payment after they were diagnosed?

- Were they able to maintain their lifestyle if they or their spouse couldn’t return to work full time?

- Did they have timely access to the world’s “best” medical knowledge and treatments?

The cost of survival can be far more than the cost of the treatment. You don’t survive without paying a price.

How long would it take you to save $50,000? How long would it take you to exhaust $50,000 if you suffered a critical illness?

Earnings potential to age 65:

Survival comes at a cost… Where will the money come from?

- Withdraw from your retirement plan – your RRSP’s?

- Borrow funds? (will the bank lend you money if you are not working and disabled?)

- Government Health care plans?

- Disability Insurance?

How will the cash be used?

- pay down debts: mortgage, car loans or credit cards

- medical treatment not covered by provincial health plans

- medical treatment outside of Canada

- travel and living expenses

- cover lost income

- take extended leave from work to fully recover

- medical equipment or devices

- child or home care

- therapy (speech, physiotherapy etc.)

Would you rather have a heart attack and lose your house?

Would you rather have a heart attack and lose your house?

Or, have a heart attack and lose your mortgage?

Did you know that half of all mortgage foreclosures are as a result of disability and that 90 per cent of disabilities are from illness and not accident?

*46% of mortgage foreclosures are due to an inability to make mortgage payments due to a critical illness – 3% of all foreclosures are a result of death in the household.

Critical Illness is also available to children between the ages 2-19. It provides the financial assistance when your family needs it the most. You are able to take time off work so you can be with your child, hire a caregiver for your child, and cover the cost of transportation and accommodations to travel for treatments. Since Vancouver is the nearest major city to facilitate most treatments, it’s a big issue for us here on the island.

On a personal note I know 3 people who recently suffered a critical illness – one was diagnosed with Breast Cancer (needing a double mastectomy), the other had evasive melanoma, and the other had a heart attack – needing angioplasty – in these cases – they had coverage – and were paid a tax-free sum of money because they survived. They did not have to worry about money – just recovery.

I also have a friend that suffered severe 3rd degree burns to 20% of his body and I know another gentleman in his 40’s who had a heart attack, 2 little kids and a stay home mom, who had to go back to work and he had to go back to work sooner that he probably should have because they did not want to lose their house. Both did not even know that this protection was available.

Getting Basic Critical Illness Insurance is easy:

- Applying for coverage is easy: no medical questionnaire required.

You choose the level of coverage: there are three levels of coverage from which to choose – $25,000, $50,000 and $75,000

- You choose how to spend it: the lump sum benefit is paid directly to you, to spend any way you please. Pay medical expenses, retrofit your home, alleviate debt, travel… use the money however you wish!

- Comprehensive coverage: covers five of the most common critical illnesses and conditions – cancer, heart attack, stroke, coronary artery bypass surgery and aortic surgery.

- Health Service Navigator included at NO EXTRA COST: With Health Service Navigator, you and your eligible family members can quickly and easily get answers to your questions and access to support services. One simple call to a dedicated toll-free line and you will be connected to Health Service Navigator where you can receive information, medical coordination services and resources on how to navigate the Canadian health care system. And, if you want a second opinion from a world-class hospital, Health Service Navigator will help you get it.

Click here for free quote and information on Basic Critical Illness