To find out how much tax savings you will get by having RRSP contributions for 2009 or by back filling any unused contribution room you may have, please click the link below.

RRSP Contribution Tax Benefit Calculator

The maximum RRSP deduction limit for 2010 is $22,000. However, if you did not use your entire RRSP deduction limit for the years 1991-2009, you can carry forward the unused amount to 2008. Therefore, your RRSP deduction limit for 2010 may be more than $22,000.

REGISTERED RETIREMENT INCOME FUNDS (RRIFS)

An RRSP must be converted to a RRIF no later than December 31 of the year in which the RRSP annuitant turns 71.

Helpful information you should know

When it comes to investing for your retirement, registered retirement savings plans (RRSP’s) are the best place to start. The combined benefits of reducing taxable income in the present and the expectation of tax-sheltered compound investment returns over the long term provide a compelling reason for investors to make the most of these savings plans.

There are a number of tactics you can use that will help you realize the full wealth-building potential that these plans can provide. What follows are a few tips on how to make the most of every dollar you invest.

1. Start as early as you can

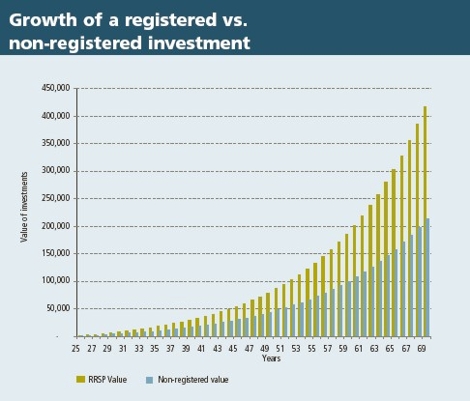

You’ve likely seen numbers there before, but they are worth repeating: to take full advantage of the taxable benefits associated with an RRSP, the sooner you start investing the better. As Figure 1 illustrates, the longer your savings have to compound tax free, the more you benefit from the tax-sheltered investment returns that RRSP’s provide.

As a means of comparison, the growth of the same investment held within a non-registered account is illustrated to show how tax deferral can work to your advantage over time. The RRSP investor starts at age 25, contributes $1,000 per year, receives an average 8 per cent annual rate of return on the investment, and is subject to a tax rate of 40 per cent. The final contribution is made at age 69.

The non-registered investor starts at age 25, also wants to contribute $1,000 but has to pay tax on this amount first, leaving only $600 to invest per year, receives the same 8 per cent return on investment, and is subject to a tax rate of 40 per cent. Again, the final contribution is made at age 69.

The end result is that by taking advantage of the tax-deferred benefits of a registered account, the value of the plan increased to $417,426 at age 69. This compares to the non-registered account whose value is a mere $214,182.

The difference: $203,244*

Growth of a registered vs. non-registered investment

Figure 1

*This example assumes that the taxable portion of the fund return is 25%, the tax rate on investment earnings is 25 per cent and the annual income tax payable by the non-registered investor must be paid through withdrawals from the fund.

2. Maximize your contributions

Maximize your contributions each year to make the most of tax-deferred compound investment returns. Consider a RRSP loan if you don’t have the cash, and then pay it down when you receive your refund each year.

If you have unused contribution room available, consider borrowing enough money to help you catch up. Many financial institutions offer RRSP loans at very attractive rates.

3. Reinvest your refund

To get more retirement benefits from your RRSP, you can reinvest all of your refund back into your RRSP (if you have contribution room available). Assuming you are in the highest tax bracket and you invest $1,000, you could generate a $500 refund. If you spend the refund, your true after-tax commitment to your retirement goal is only $500. But if you invest that tax refund, you increase your RRSP by 50 per cent. Your RRSP investment now becomes $1,500, which represents a significant increase to your overall financial plan.

4. Maximize your foreign content

You may hold up to 30 per cent of the book value of your total RRSP holdings in foreign property. And with more than 97 per cent of the world’s investment opportunities available outside our borders, it only makes sense to consider investing abroad.

Allocating a portion of your RRSP to foreign investments not only provides you with the potential to earn higher returns, it also allows you to diversify your holdings across different asset classes, which can be an important factor in reducing investment risk over time.

The book value is the initial price you paid for each investment within your plan plus any reinvested distributions. The market value is what each of those investments is worth today. If you exceed the 30 per cent limit, your registered plan will be charged a penalty of 1 per cent per month on the excess amount. To help you avoid these penalties, consider taking advantage of 100 per cent RRSP-eligible foreign equity funds that many mutual fund companies now offer.

5. Pay yourself first

Consider contributing to your retirement through convenient, automatic withdrawals from your chequing account. If you are a mutual fund investor, a pre-authorized contribution (PAC) plan will allow to contribute as little as $50 either weekly, bi-weekly, monthly, quarterly or semiannually into a mutual fund that’s right for you. A PAC plan lets you take advantage of dollar-cost-averaging, a strategy that can help lower investment risk. Dollar-cost-averaging can lower investment risk since you will be automatically buying fewer units when prices are high and more units when prices are low.

6. Consolidate your investments

If you are the type of investor who doesn’t want to spend a great deal of time managing multiple investment accounts, then you should consider consolidating your holdings with one advisor. By consolidating all of your RRSP holdings into a single account, you can still invest in many different types of investments and it will make it easier to adjust your investment strategy as your financial situation changes over the years. In addition, you won’t have to pay extra RRSP administration fees that can cost as much as $100 per year for each account.

RRSP Facts

- Average net worth for adult Canadians: $235,400

- Number of Canadians contributing to an RRSP: 6 million

- Amount contributed to RRSP’s in 2002: $27.1 billion

- Percentage of adult Canadians with an RRSP: 69

- Percentage of Canadian families with RRSP savings: 55

- Average value: $51,200

- Canadian private pension assets held in employer pension plans: $604 billion

- RRSP’s or RRIF’s: $408 billion

Sources: General Social Survey, Statistics Canada 2002. Study of Canadians’ Attitudes Toward Financial Planning – Wave 2, Financial Planners Standards Council, Finance Canada.

Sources: General Social Survey, Statistics Canada 2002. Study of Canadians’ Attitudes Toward Financial Planning – Wave 2, Financial Planners Standards Council, Finance Canada.