What is leverage?

Traditional investing is simple: earn money…save money…invest money. This is a time-tested strategy. But did you know that your money isn’t working as hard as it could be?

With a leverage strategy, your money can work harder for you. Rather than making a series of small contributions over a long period of time, when you take out an investment loan, you invest a larger amount all at once. This allows a much larger investment to grow for your full investment period. Then, instead of making additional contributions to your investment, you make the interest payments on your loan.

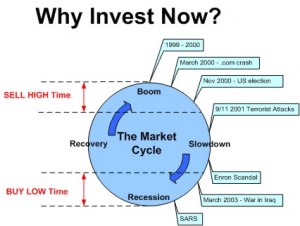

Why does leverage work?

There are two powerful forces driving this strategy:

Compound returns. An investment loan allows a larger amount to grow for longer – which can generate a much larger long-term return.

Tax deductibility. Interest charged on an investment loan is generally tax-deductible. This reduces the cost of the loan.

Add some G.A.S. to your retirement plan! Up to $50,000 to kick start your retirement!

(Guaranteed Advance Strategy, O.A.C.)

Call me for more details!

Discuss the risks associated with leveraged mutual fund purchases with a financial planner before investing. Purchases are subject to suitability requirements. Using borrowed money to finance the purchase of securities involves greater risk than a purchase using cash resources only. If you borrow money to purchase securities, your responsibility to repay the loan and pay interest as required by its terms remains the same if the value of the securities purchased declines.