Disability Insurance

What would you do if your income stopped today?

Where would the money come for your living expenses?

Would your business survive if you, a partner or an employee were disabled?

Disability insurance provides you with financial security when an accident or illness causes you to be disabled and unable to work or earn an income.

When you’re healthy and working, it’s hard to imagine being disabled by illness or injury. But it can happen. In fact:

When you’re healthy and working, it’s hard to imagine being disabled by illness or injury. But it can happen. In fact:

- One in 3 working Canadians will become disabled for 90 days or more before age 65.

- The average disability absence is 2 and a half years.

- More than 80% of working Canadians don’t have disability income insurance or are not covered adequately.Like most Canadians, you probably carry some form of home and car insurance. And, each year, you spend hundreds of dollars insuring these items. But, do you insure your most valuable asset your income?

To see how valuable an asset your income is, fill in the chart below. Determine how much your major assets are worth, and how much you pay each year to insure them.

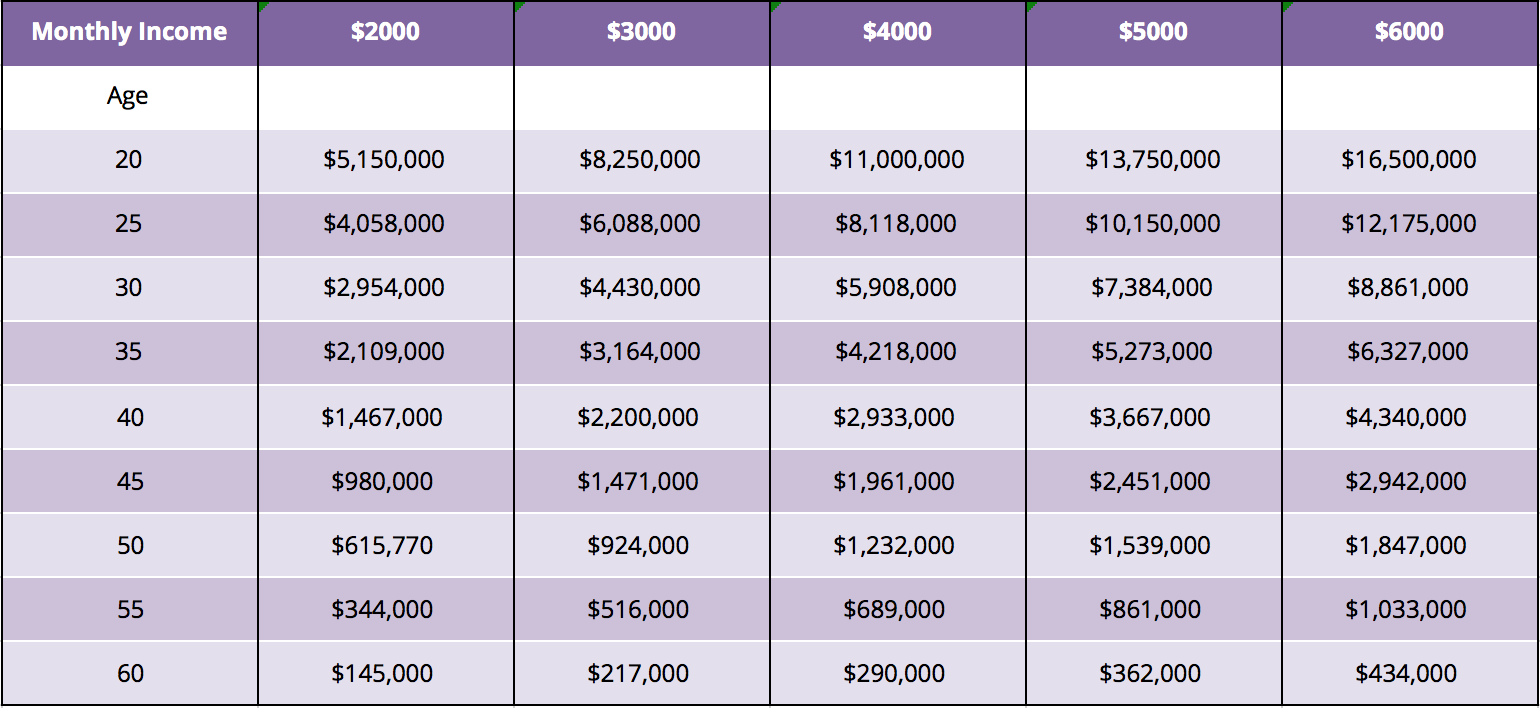

* To determine your potential earnings to age 65, find your age and your monthly salary on the chart below.Now, look at the columns and numbers you have filled in. Have you protected your car and house? Could you continue to pay for this protection without an income? How could you make your car or mortgage payments?

Have you insured your full potential earnings to age 65? With your income being your most valuable asset, isn’t it worth protecting?

Assuming a 2% increase each year, these are your potential earnings up to age 65.